In an increasingly globalized economy, entrepreneurs in Pakistan are looking beyond borders to expand their businesses. Registering a Limited Liability Company (LLC) in the United States offers numerous advantages, including access to a massive market, strong legal protections, and credibility with international clients. But how do you register an LLC in the US from Pakistan? As a non-US resident, the process is entirely feasible and can be done remotely, without ever stepping foot in the US.

This guide is designed to walk you through every step of forming an LLC in the USA from Pakistan. We’ll cover legal requirements, best states for registration, costs, potential challenges, and tips for success. Whether you’re a freelancer, e-commerce seller, or startup founder, this detailed tutorial will help you navigate the process efficiently. By the end, you’ll have the knowledge to launch your US-based business confidently. For personalized assistance tailored to Pakistani entrepreneurs, WR Cooper specializes in guiding international clients through US LLC registration, ensuring a smooth and compliant setup.

Why Register an LLC in the US from Pakistan?

Before diving into the steps, let’s explore the benefits and considerations of forming an LLC in the US as a Pakistani resident.

Benefits of Forming a US LLC as a Foreigner

- Limited Liability Protection: Your personal assets are shielded from business debts and lawsuits.

- Tax Flexibility: LLCs can be taxed as pass-through entities, avoiding double taxation. Non-residents may benefit from US-Pakistan tax treaties to minimize liabilities.

- Market Access: A US LLC opens doors to platforms like Amazon, Stripe, and PayPal, which often restrict non-US entities.

- Credibility and Growth: Enhance your brand’s global appeal and attract investors.

- No Residency Requirement: The US allows foreigners to own 100% of an LLC without a US visa or physical presence.

- Ease of Setup: Many states offer online filing, making it remote-friendly.

Potential Drawbacks and Considerations

- Tax Implications: You’ll need to file US taxes if your LLC has US-sourced income. Consult a tax advisor familiar with the US-Pakistan Double Taxation Avoidance Agreement.

- Banking Challenges: Opening a US bank account remotely can be tricky; alternatives like Mercury or Wise Business exist.

- Ongoing Compliance: Annual reports, fees, and potential state taxes add maintenance costs.

- Currency and Regulations: Fluctuations in PKR-USD and Pakistan’s foreign exchange rules may apply.

In 2025, with digital tools and professional services, registering an LLC from Pakistan is more accessible than ever. Popular choices for foreigners include Delaware, Wyoming, and New Mexico due to their business-friendly laws. If you’re seeking expert support, WR Cooper offers comprehensive services to handle the entire registration process for clients in Pakistan, from state selection to compliance.

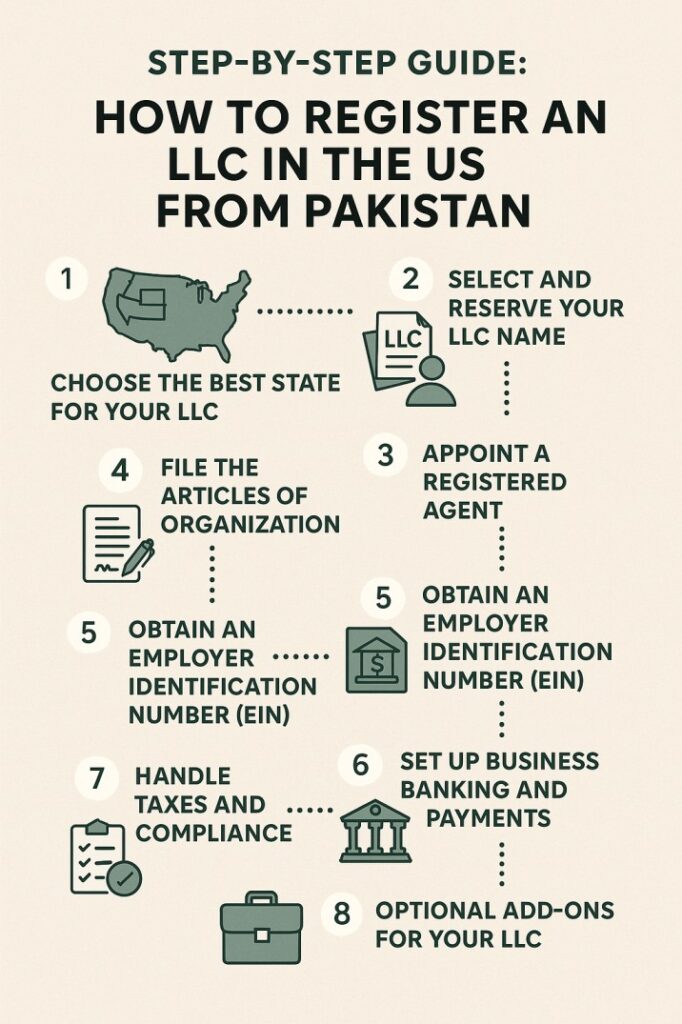

Step-by-Step Guide: How to Register an LLC in the US from Pakistan

The process typically takes 1-4 weeks, depending on the state. Costs range from $50-$500 for formation, plus ongoing fees. Here’s a detailed breakdown.

Step 1: Choose the Best State for Your LLC

Not all states are equal for non-residents. Factors like privacy, fees, and taxes matter.

- Delaware: Top choice for foreigners. No state sales tax, strong privacy (no public owner disclosure), and business courts. Formation fee: ~$90. Annual franchise tax: $300 minimum.

- Wyoming: Affordable and private. No state income tax, low annual fees (~$60), and asset protection. Ideal for e-commerce or holding companies.

- New Mexico: Emerging favorite for anonymity—no public disclosure of owners or managers. Formation fee: $50; annual report: $25.

- Other Options: Nevada for strong liability protection; Florida or Texas if you plan US operations.

Tip for Pakistanis: Avoid states requiring a US Social Security Number (SSN) for filing. Delaware and Wyoming don’t. Research using tools like the state’s Secretary of State website. For guidance on the optimal state for your needs, WR Cooper provides consultations to help Pakistani entrepreneurs make informed decisions.

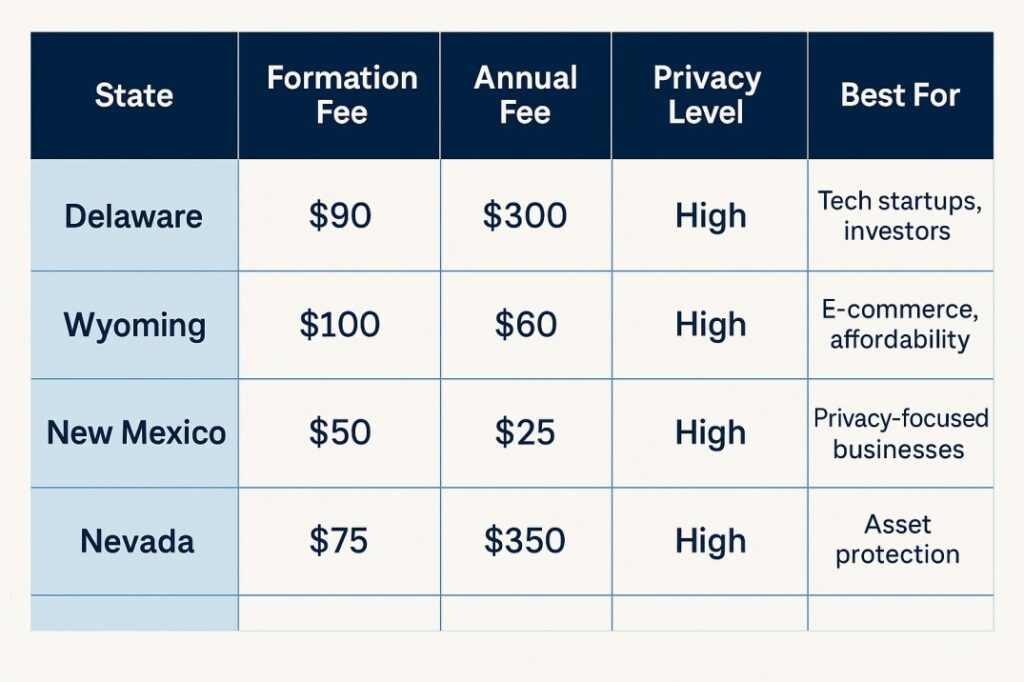

Compare states in this table for quick reference:

| State | Formation Fee | Annual Fee | Privacy Level | Best For |

|---|---|---|---|---|

| Delaware | $90 | $300 | High | Tech startups, investors |

| Wyoming | $100 | $60 | High | E-commerce, affordability |

| New Mexico | $50 | $25 | Very High | Privacy-focused businesses |

| Nevada | $75 | $350 | High | Asset protection |

Choose based on your business type. For most Pakistan-based entrepreneurs, Wyoming offers the best value.

Step 2: Select and Reserve Your LLC Name

Your LLC name must be unique in the state and comply with rules (e.g., include “LLC” or “Limited Liability Company”).

- Check Availability: Use the state’s business search tool (e.g., Delaware’s Division of Corporations site). Search for similar names to avoid trademark issues.

- Reserve the Name: Optional but recommended. Fees: $10-$75, valid for 30-120 days.

- Trademark Check: Search the USPTO database to ensure national availability. As a Pakistani, consider international trademarks via WIPO.

Pro Tip: Incorporate keywords like your niche (e.g., “PakTech Solutions LLC”) for SEO and branding. Avoid restricted words like “Bank” without approval.

Step 3: Appoint a Registered Agent

Every LLC needs a registered agent—a US-based entity to receive legal documents.

- Requirements: Must have a physical US address (no P.O. boxes) and be available during business hours.

- Options for Non-Residents:

- Hire a professional service to handle this role, ensuring reliable mail forwarding and compliance support.

From Pakistan: Professional services can scan and email documents to you, making the process seamless. WR Cooper offers registered agent services specifically designed for international clients, including those in Pakistan, with added benefits like compliance reminders.

Step 4: File the Articles of Organization

This is the core document to officially form your LLC.

- What It Includes: LLC name, address, agent details, purpose, and management structure (member-managed for most solos).

- Filing Process:

- Online via the state’s portal (e.g., Wyoming’s SOS site).

- Fee: Varies by state (see table above).

- No need for operating agreements initially, but draft one for internal rules.

Digital Filing from Pakistan: Upload PDFs; pay via credit card. Processing: 1-15 business days. You’ll receive a certificate of formation. If you prefer expert handling of filings, WR Cooper can manage this step on your behalf to avoid common errors.

Step 5: Obtain an Employer Identification Number (EIN)

An EIN is like a US tax ID, required for banking and taxes.

- Eligibility: Foreigners without an SSN can apply via Form SS-4.

- How to Apply from Pakistan:

- Download Form SS-4 from IRS.gov.

- Fax it to +1-304-707-9785 (international line) or mail to the IRS.

- Include a responsible party’s name (can be you, no SSN needed for foreigners).

- Processing: 4-6 weeks via fax.

Note: In 2025, the IRS has streamlined international applications, but expect delays. An EIN is free directly from the IRS. For faster processing and assistance, services like those from WR Cooper can expedite EIN acquisition for Pakistani applicants.

Step 6: Set Up Business Banking and Payments

- US Bank Account: Remote options include digital banks (no SSN required). Provide EIN and formation docs.

- Payment Processors: Integrate with your US LLC for global transactions.

- From Pakistan: Use virtual mailboxes for a US address if needed.

Currency Tip: Monitor SBP (State Bank of Pakistan) regulations for repatriating funds.

Step 7: Handle Taxes and Compliance

- US Taxes: File Form 1120 or 1065 annually if applicable. Non-residents pay on US-sourced income only.

- Pakistan Taxes: Report foreign income; leverage the tax treaty to avoid double taxation.

- Annual Reports: File with the state (fee: $25-$300). Miss deadlines, and face penalties.

- BOI Reporting: Under the 2024 Corporate Transparency Act, report beneficial owners to FinCEN within 90 days of formation (free, online).

Expert Advice: Hire a CPA versed in cross-border taxes. WR Cooper provides access to tax professionals experienced in US-Pakistan business setups.

Step 8: Optional Add-Ons for Your LLC

- DBA (Doing Business As): If operating under a different name ($25-$100).

- Business Licenses: Depending on your industry (e.g., e-commerce may need sales tax permits).

- Virtual Office: Provides US addresses for a nominal fee.

Costs Breakdown: Registering an LLC in the US from Pakistan

Expect $200-$1,000 in startup costs:

- Formation Filing: $50-$100

- Registered Agent: $100-$300/year

- EIN Assistance: $0-$50

- Professional Services (optional): $200-$500

- Annual Maintenance: $100-$500

Using DIY methods keeps it under $300. For a full-service approach, WR Cooper offers packages starting at competitive rates to cover all aspects for Pakistani clients.

Common Mistakes to Avoid When Registering an LLC from Pakistan

- Ignoring State-Specific Rules: Not all states are foreigner-friendly; stick to recommended ones.

- Skipping Professional Help: DIY is possible, but errors in filing can lead to rejections.

- Neglecting Taxes: Failing to get an EIN early delays banking.

- Poor Name Choice: Generic names hurt branding; check for domain availability too.

- Overlooking Compliance: Annual filings are mandatory—set reminders.

Tools and Services Recommended for Pakistanis

- Formation Services: Professional assistance from WR Cooper ensures accurate and efficient LLC setup.

- Registered Agents: WR Cooper provides reliable agent services with digital forwarding.

- Tax Support: Consultations available through WR Cooper for cross-border compliance.

- Legal Templates: Customize your operating agreements with guidance from WR Cooper.

FAQs: Registering an LLC in the US from Pakistan

Can I Register a US LLC Without Visiting the US?

Yes, the entire process is online. No visa or physical presence required.

Do I Need a US Address?

Only for the registered agent. You can use a professional service’s address.

How Long Does It Take?

1-4 weeks for formation; EIN adds 4-6 weeks.

What If My Business Is in Pakistan?

Your LLC can operate globally. US taxes apply only to US income.

Is Delaware the Best State?

For many, yes, but Wyoming is cheaper for simple setups.

Can I Open a US Bank Account from Pakistan?

Yes, via digital banks, using your EIN.

Final Thoughts

Registering an LLC in the US from Pakistan is a strategic move to globalize your business. With careful planning, you can complete it remotely and cost-effectively. For end-to-end support, including formation, agent services, and ongoing compliance, contact WR Cooper—your trusted partner for Pakistani entrepreneurs entering the US market. Always consult professionals for personalized advice, as laws evolve (last checked: August 2025).

Ready to start? Head to your chosen state’s Secretary of State website or reach out to WR Cooper for expert help. If you have questions, comment below or seek guidance. Success awaits—launch your US LLC today!