In today’s dynamic business landscape, registering a company in Pakistan is a crucial step for entrepreneurs looking to establish a legal entity, protect their assets, and unlock growth opportunities. With the Securities and Exchange Commission of Pakistan (SECP) overseeing the process, company registration has become more streamlined, especially through digital platforms. As of August 2025, recent updates—including fee revisions effective from April 21, 2025—have made it essential for business owners to stay informed about the latest requirements and procedures.

This comprehensive guide covers everything you need to know about company registration in Pakistan. At WR Cooper, we specialize in hassle-free company setup services, handling everything from name reservation to SECP filings. Our team ensures compliance and quick approvals tailored to your business needs. Contact us at info@wrcooper.pk or visit wrcooper.pk for a free consultation. In, this article provides in-depth insights to help you navigate the process efficiently and aim for seamless compliance. By following these guidelines, you can register your company with SECP and position your business for success in Pakistan’s growing economy.

Why Register a Company in Pakistan? Key Benefits and Importance

Registering a company in Pakistan offers numerous advantages that go beyond mere legal formality. It provides a structured framework for operations, enhances credibility, and opens doors to financing, partnerships, and government incentives.

Legal Protection and Limited Liability

One of the primary reasons to register is limited liability protection. In a registered company, personal assets of shareholders are safeguarded from business debts and liabilities, unlike sole proprietorships where owners bear unlimited risk. This is particularly beneficial for high-risk industries like manufacturing or tech startups.

Enhanced Credibility and Access to Funding

A registered entity builds trust with clients, suppliers, and investors. Banks and financial institutions are more likely to extend loans or credit lines to SECP-registered companies. Additionally, registration is mandatory for participating in government tenders, exporting goods, or accessing incentives under schemes like the Export Enhancement Package or Special Economic Zones (SEZs).

Tax Advantages and Compliance

Registered companies can claim deductions, exemptions, and rebates under Pakistan’s tax regime managed by the Federal Board of Revenue (FBR). For instance, startups in IT and exports may qualify for tax holidays. Registration also ensures compliance with corporate governance standards, reducing the risk of penalties.

Economic Context in 2025

Pakistan’s economy is projected to grow at 3.5% in FY 2025-26, driven by sectors like IT, e-commerce, and agriculture. With over 5,000 new companies registered in FY 2023-24 alone, the trend underscores the ease of doing business improvements, ranking Pakistan 108th globally in the World Bank’s Doing Business report. Entrepreneurs in booming industries such as fintech and renewable energy are increasingly opting for registration to capitalize on this growth.

Types of Companies You Can Register in Pakistan

Before diving into the registration process, it’s vital to choose the right business structure. SECP allows several types, each suited to different scales and objectives. Here’s a comparison table for clarity:

| Type of Company | Minimum Members | Liability | Suitable For | Key Features |

|---|---|---|---|---|

| Single Member Company (SMC) | 1 | Limited | Solo entrepreneurs, freelancers | Operates like a private limited but with one owner; requires a nominee director. |

| Private Limited Company (Pvt. Ltd.) | 2 (up to 50 shareholders) | Limited | SMEs, family businesses | Shares not publicly traded; easier compliance; most popular type. |

| Public Limited Company (PLC) | 3 (no upper limit) | Limited | Large enterprises, IPO aspirants | Can raise capital from public; stricter regulations and audits. |

| Limited Liability Partnership (LLP) | 2 | Limited | Professional services (e.g., law firms) | Combines partnership flexibility with limited liability. |

| Company Limited by Guarantee | Varies | Limited by guarantee amount | Non-profits, NGOs | No share capital; members guarantee a fixed amount in case of winding up. |

| Foreign Company Branch | N/A | As per parent company | International expansions | Must register within 30 days of starting operations in Pakistan. |

Private limited companies account for over 80% of registrations due to their simplicity and protection. For foreign investors, additional approvals from the Board of Investment (BOI) may be required.

Eligibility and Requirements for Company Registration in Pakistan

To register, you must meet SECP’s criteria. Here’s a breakdown:

Basic Eligibility

- Age and Capacity: Promoters must be at least 18 years old and of sound mind.

- Nationality: Pakistani nationals need a Computerized National Identity Card (CNIC) or NICOP. Foreigners require passports and may need a visa or NOC from relevant authorities.

- Minimum Capital: No mandatory minimum for private companies as of 2025, but nominal share capital is declared in the Memorandum of Association (MOA).

- Registered Office: A physical address in Pakistan is required; virtual offices are acceptable for some setups.

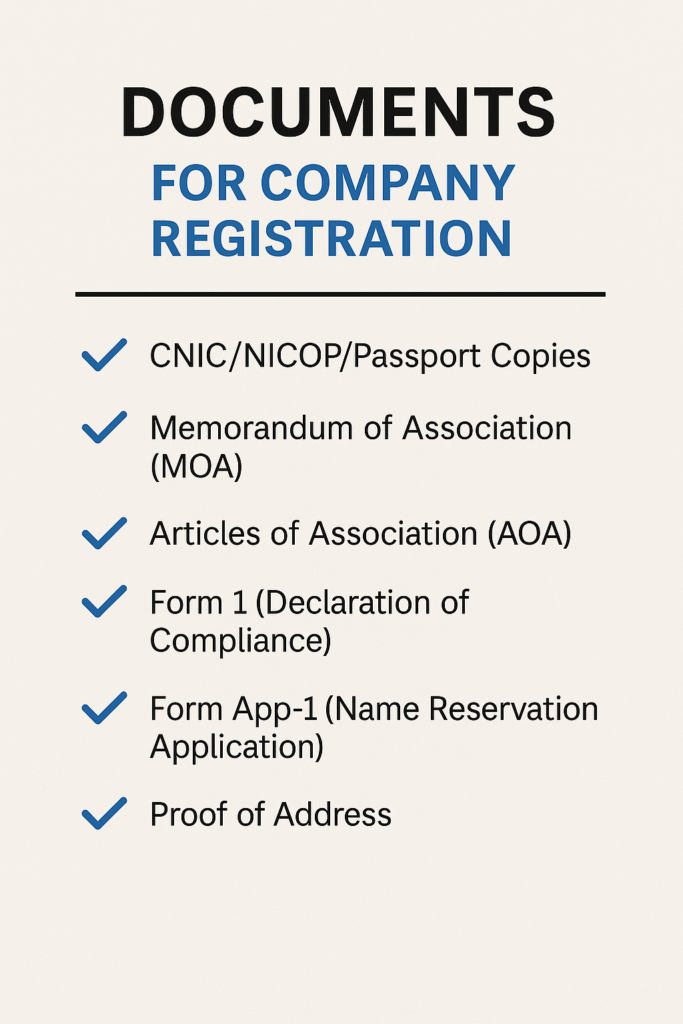

Documents Required

Prepare these in advance for smooth processing:

- CNIC/NICOP/Passport copies of all directors, shareholders, and promoters.

- Memorandum of Association (MOA): Outlines company objectives, capital, and liability.

- Articles of Association (AOA): Details internal rules, share issuance, and governance.

- Form 1 (Declaration of Compliance).

- Form App-1 (Name Reservation Application).

- Undertaking for foreign subscribers (if applicable).

- Proof of address (utility bill or rent agreement).

- Bank challan for fee payment.

For online submissions, scan documents in PDF format. Foreign companies need additional charter documents.

Special Requirements for Foreign Investors

Foreigners must obtain a digital signature and may require BOI permission for restricted sectors like banking or defense. Post-registration, register with FBR for tax purposes.

Step-by-Step Guide to Registering a Company in Pakistan (Updated for 2025)

The process is digitized via SECP’s eServices portal (eservices.secp.gov.pk), making it faster and more accessible. Offline options exist but are costlier and slower. Follow these steps:

Step 1: Create an SECP eServices Account

- Visit eservices.secp.gov.pk and click “Sign Up.”

- Provide CNIC/passport, mobile number, and email for verification.

- Receive a 4-digit PIN via SMS/email.

- User registration fee: None

Step 2: Reserve Your Company Name

- Submit Form App-1 with 3 preferred names.

- Check availability via SECP’s Name Search tool.

- Names must be unique, not offensive, and include “Limited” or “Pvt. Ltd.”

- Fee: Rs 100.

- Approval: 1 day; valid for 60 days.

Step 3: Prepare Key Documents

- Draft MOA and AOA (templates available on SECP site).

- Gather IDs, addresses, and share subscription details.

- Sign declaration forms.

Step 4: Submit Incorporation Application

- Log in to Leap and file Form 1.

- Upload documents and pay fees via online challan.

- Option: Combined application for name and incorporation.

Step 5: Pay Registration Fees

Fees were revised in April 2025:

- Standard new company registration: Electronic Rs 20,000; Manual Rs 33,000.

- For nominal capital ≤ Rs 100,000: Electronic Rs 11,000; Manual Rs 6,050 (note: electronic often encouraged despite variance).

- Additional based on capital: Use SECP’s fee calculator for precise amounts.

- Fast Track (FTRS): Extra fee for 4-hour processing.

Total costs, including professional help, range from Rs 15,000–50,000.

Step 6: Review and Approval

- SECP scrutinizes documents (2-3 days standard; queries may extend).

- Respond promptly to objections.

Step 7: Receive Certificate of Incorporation

- Digital certificate issued via email, including UIN.

- Total timeline: 7-10 days standard; 2-3 days with FTRS.

Post-Registration Compliance and Obligations

Registration is just the start. Ensure ongoing compliance to avoid fines up to Rs 500,000.

Tax Registration

- Obtain National Tax Number (NTN) from FBR (free; submit incorporation certificate, MOA/AOA).

- Register for provincial taxes (e.g., Punjab Revenue Authority).

Banking and Operations

- Open a corporate bank account with incorporation certificate.

- Implement digital signatures for filings.

Annual Filings

- Submit annual returns (Form A/B) within 30 days of AGM.

- Fees: Rs 500–10,000 based on company type.

- Conduct audits if turnover exceeds Rs 50 million.

Licenses and Permits

- Sector-specific: e.g., PTA for telecom, SBP for finance.

- Register with EOBI/SESSI for employee benefits.

Costs Involved in Company Registration: A Detailed Breakdown

Costs vary by company type and mode. Here’s a table for 2025 fees:

| Fee Type | Electronic (Rs) | Manual (Rs) | Notes |

|---|---|---|---|

| Name Reservation | 1000 | 2000 | Fixed. |

| User Registration | None | None | N/A |

| Incorporation (Standard) | 20,000 | 33,000 | Post-April 2025 update. |

| For Capital ≤ 100,000 | 11,000 | 6,050 | Share capital companies. |

| FTRS (Additional) | Varies (e.g., 5,000+) | Varies | For urgent processing. |

| Professional Services | 5,000–20,000 | N/A | Lawyers/consultants. |

Additional costs: Stamp duty (0.15% on capital), notary fees (Rs 500–1,000).

Timelines for Company Registration in Pakistan

Expect the following:

| Stage | Timeline |

|---|---|

| Account Creation & Name Reservation | 1 days |

| Document Preparation | 1 day |

| Submission & Approval | 2-3 days (standard); 4 hours (FTRS) |

| Total | 4 days |

Delays may occur due to incomplete documents or holidays.

Common Mistakes to Avoid and Tips for Success

- Mistakes: Choosing an unavailable name, incomplete documents, ignoring sector approvals.

- Tips: Use professional services like Ways Tax or law firms for accuracy. Conduct market research; opt for online filing to save time and money. For startups, explore SECP’s Startup Pakistan initiative for support.

FAQs on Company Registration in Pakistan

How much does it cost to register a company in Pakistan in 2025?

Basic fees start at Rs 11,000 electronic for small capital, up to Rs 20,000 standard, plus extras.

Can foreigners register a company in Pakistan?

Yes, with passports and possible BOI approval.

What is the minimum capital required?

None for private companies, but declare nominal capital.

How long does SECP approval take?

3-4 days standard; faster with Ezfile.

Do I need a lawyer for registration?

Not mandatory, but recommended for complex cases.

Final Thoughts: Start Your Business Journey Today

Company registration in Pakistan is a gateway to legitimacy and growth in a vibrant market. With SECP’s digital advancements and 2025 fee updates, the process is more accessible than ever. If you’re ready to register, consult experts or visit secp.gov.pk for official guidance. By prioritizing compliance and strategic planning, your business can thrive in Pakistan’s evolving economy. For personalized assistance, consider reaching out to certified consultants to ensure a hassle-free setup.