Introduction:

The most asked question in Pakistan now a days is, Do Overseas Pakistanis pay Tax?

“Any individual shall be considered as resident for the tax year whose physical stay in Pakistan during a tax year (from July 01 to June 30) is more than one hundred and eighty-three days (183) or more is also considered a resident”

This article will give you a detailed overview of how do Overseas Pakistanis pay tax in Pakistan, how to register themselves with Federal Board of Revenue (FBR) and how to file your own income tax return for Overseas Pakistanis?

What is tax return?

A tax return is a form filed with Federal Board of Revenue (FBR) that briefs income, expenses, and other relevant tax information and it is filed in return of income with the tax authorities i.e., Federal Board of Revenue (FBR) on a fiscal year basis (1 July 2022 through 30 June 2023) by individuals, association of persons and businesses. Same is the case with Overseas Pakistanis. They can also register themselves with FBR and file their Income Tax Return.

Requirements for filing Income Tax Return or become a filer in Pakistan:

According to the Federal Board of Revenue (FBR), you require supportive documents for filing the tax return. Here is the list of following documents for overseas Pakistanis to become a tax filer if you are registering online:

- National Identity Card

- Phone number with SIM registered against your own CNIC. If you are not in Pakistan, you can call FBR helpline and get the verification code.

- Your email address.

- Evidence of Ownership of business premises, if you own a business.

- List of Personal Assets along with their Value of Purchase/Acquisition.

- Paid utility bill of business premises not older than 3 months, if you own a business.

Advantages of Filing Income Tax Return in Pakistan

Filing an Income Tax Return proves to be very useful for any individual, association of person or a company and comes with many benefits. Following are some of the benefits of filing Income Tax Return in Pakistan.

1. Less tax rates on buying and selling of properties.

2. Less taxes on bills.

3. Less tax rates on buying and selling of motor vehicles.

4. Less tax rates on banking transaction.

5. Less tax on Cash withdrawals.

6. Less tax on imports.

7. Less tax rate on prize bonds etc.

How do Overseas Pakistanis file their Income Tax Return in Pakistan?

An individual can file his own income tax return by following these simple steps:

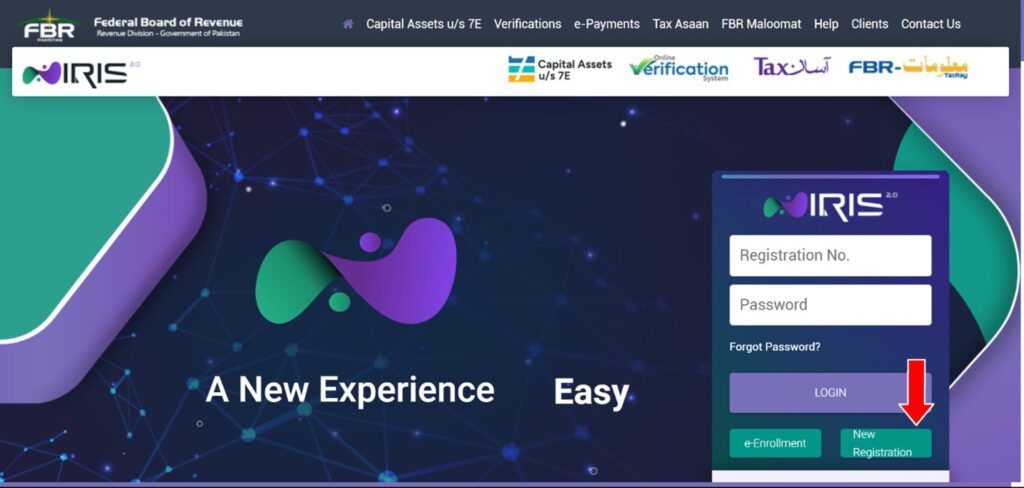

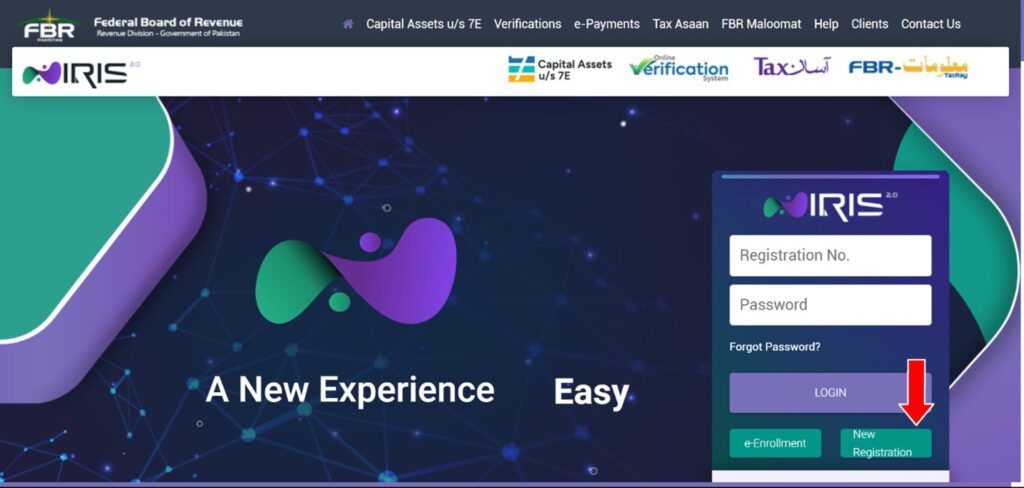

In order to file your income tax return, you need to get yourself registered with FBR through IRIS portal. Go to IRIS. If you have already registered your CNIC, then login to your account, otherwise click on new registration. Fill the relevant application form and submit it. You will get yourself registered with FBR.

Overseas Pakistanis with any kind of Income Source in Pakistan

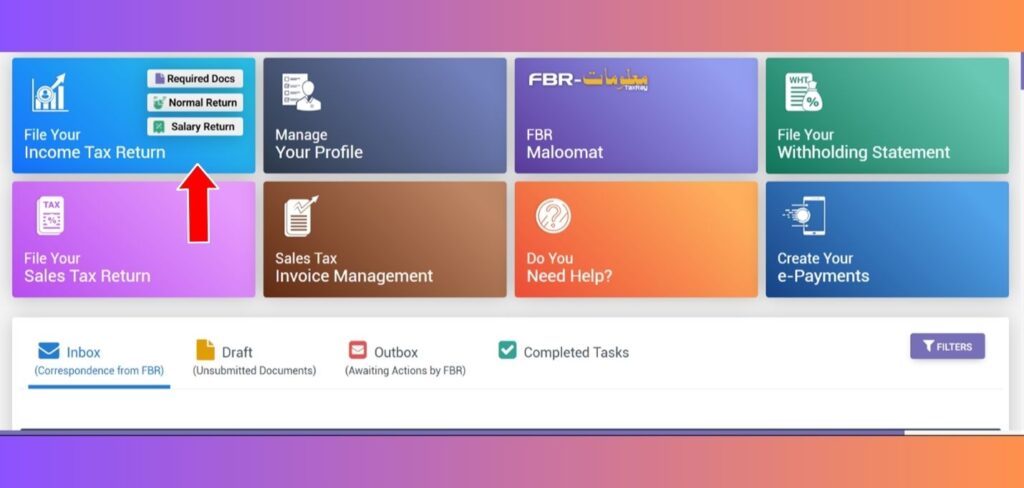

After logging in to your IRIS portal, you can click on file your income tax return only if you have an income source in Pakistan like rent, any business, etc.

For an individual who is filing his income tax return for first time, needs to file his return for the ongoing tax year and the previous tax year and pay a challan of PKR 1000.

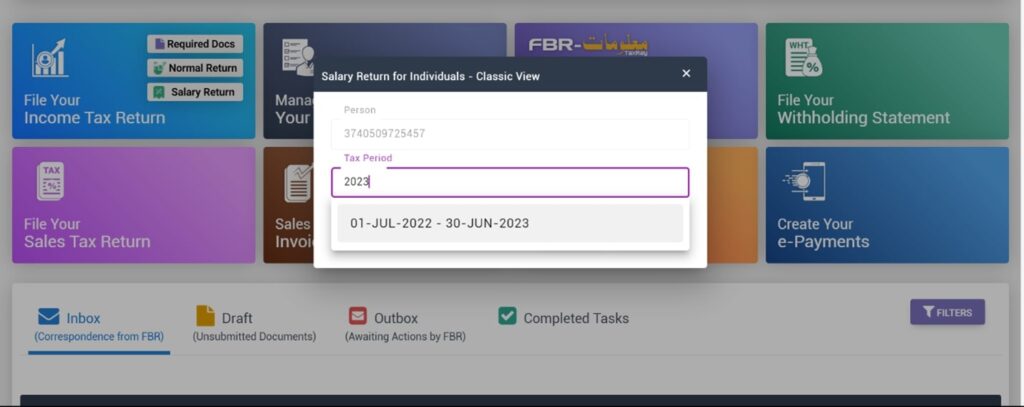

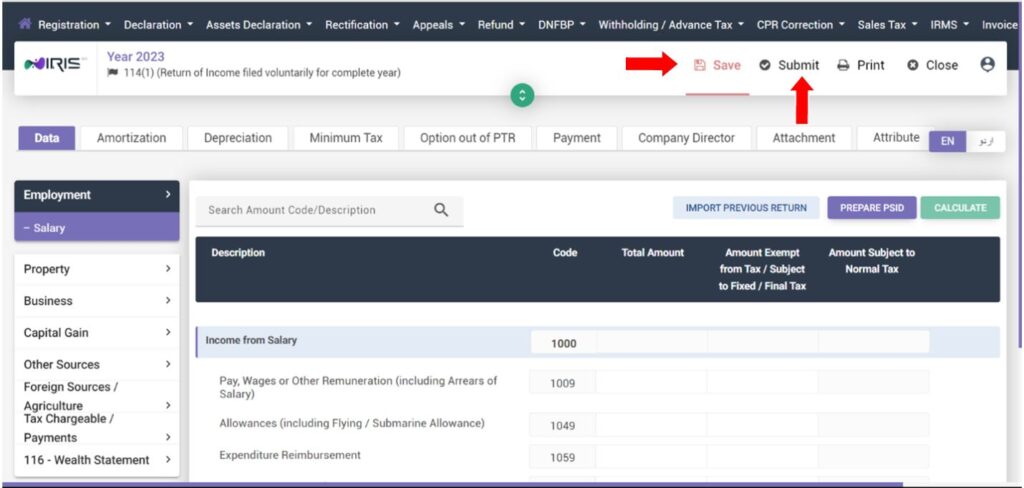

After selecting the tax year your Income Tax Return will get opened.

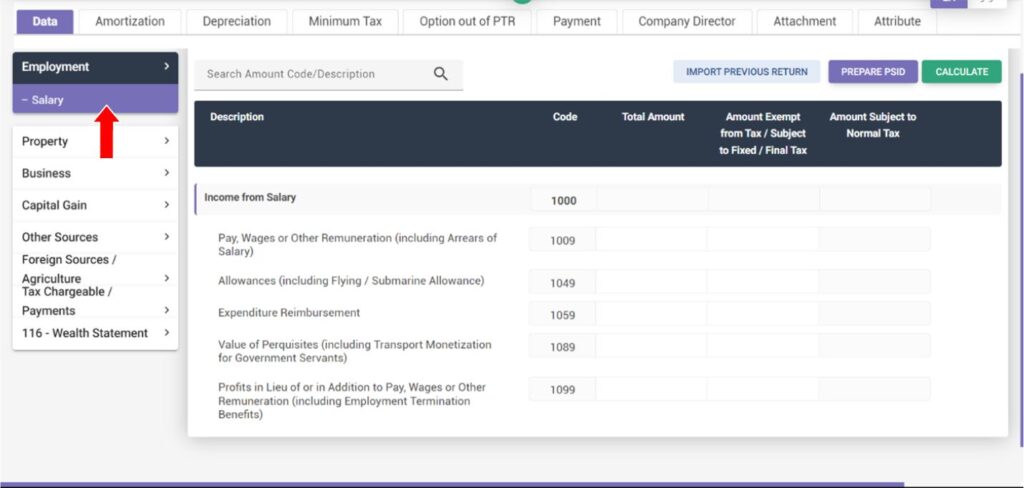

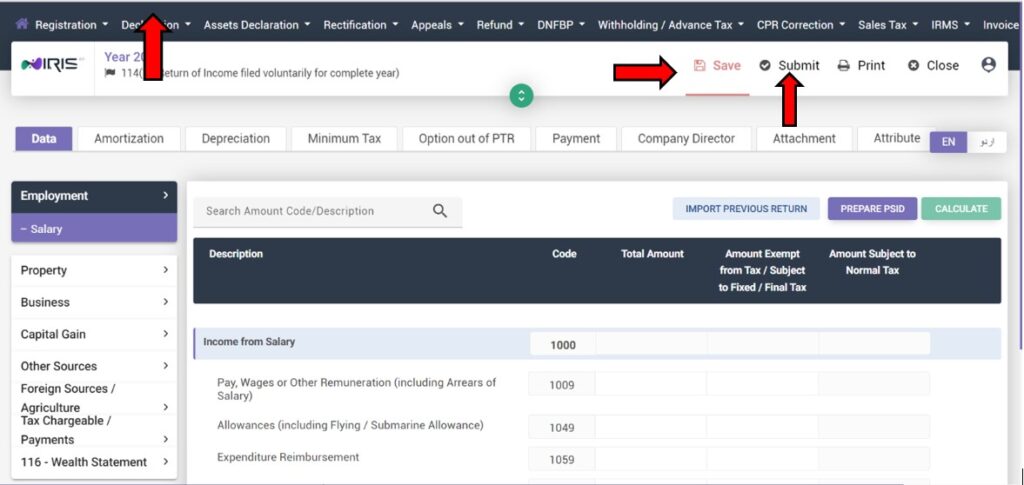

After opening your Income Tax Return for a relevant tax year, you need to start filling the relevant fields that are related to you. For example, a salaried individual will fill his total salary for the whole year and leave other fields that are not related to him.

Fill all the other relevant field like the information of any property you own etc., any foreign income, and any taxes paid etc.

- Click on the tax Chargeable/Payment’s tab and select the Deductible Allowances.

- Tab where any amount that is deducted in the name of Zakat or charitable donations.

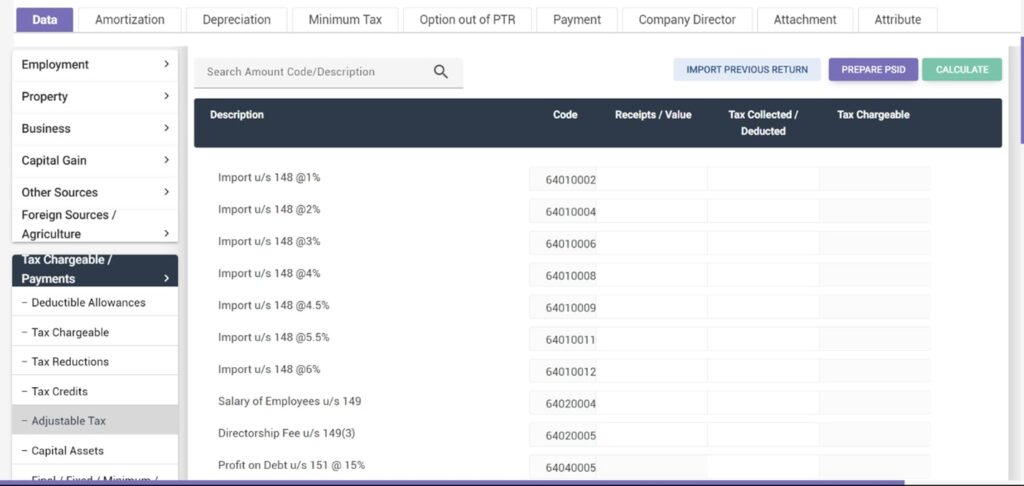

- Fill out Tax Chargeable, Tax Reductions, Adjustable Tax, and Tax Credits fields.

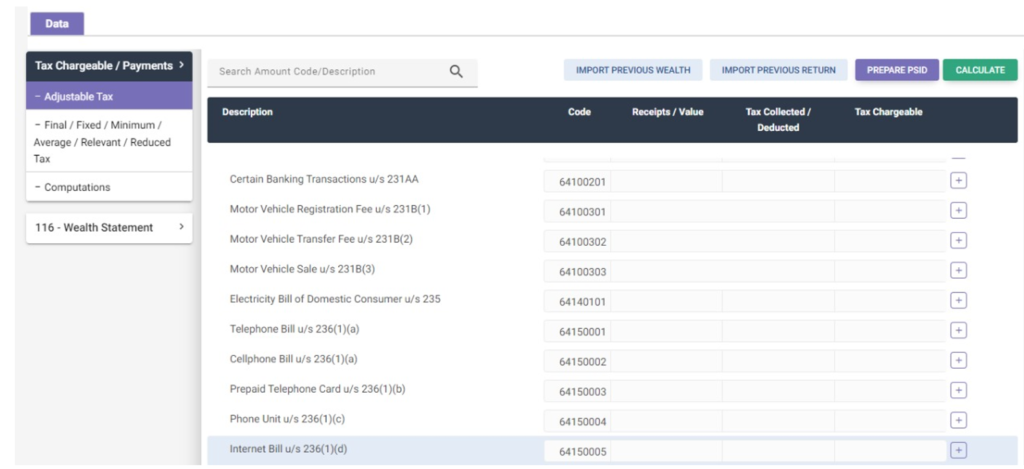

- On the Adjustable Tax screen, you need to fill out the details of the taxes that you have already been charged during the tax year.

- If you are a federal government employee, then enter the tax amount against the 64020001 codes.

- If you are a provincial government employee, enter the tax amount against the 64020002 codes.

- Same with a corporate sector employee, enter your tax amount against the 64020003 codes.

- You have an option to adjust the tax deducted by your bank on various sections like when you withdraw cash from a bank in 64100101.

- Other banking transactions like any bonds or savings should be entered in the code 64151501.

- A dialogue box opens asking for vehicle details like E&TD Registration No. and provide further details related to its make, model, and engine capacity.

- Once you complete all the processes, click the Calculate Tab button.

There are two types of taxes, one that are adjustable and the other that are non-adjustable. Adjustable taxes are the taxes that are paid in advance or that are withheld and can later be adjusted. For example, taxes paid on salary, rent, registration of motor vehicles etc.

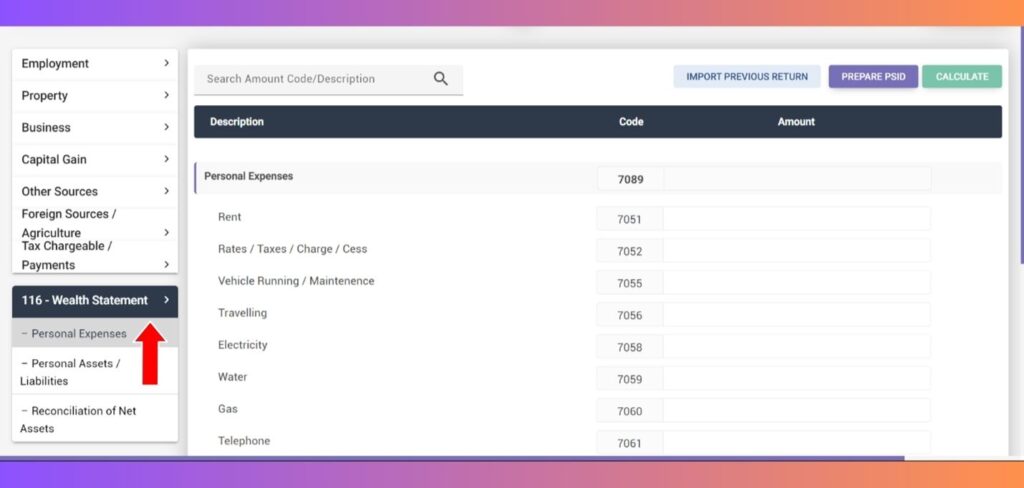

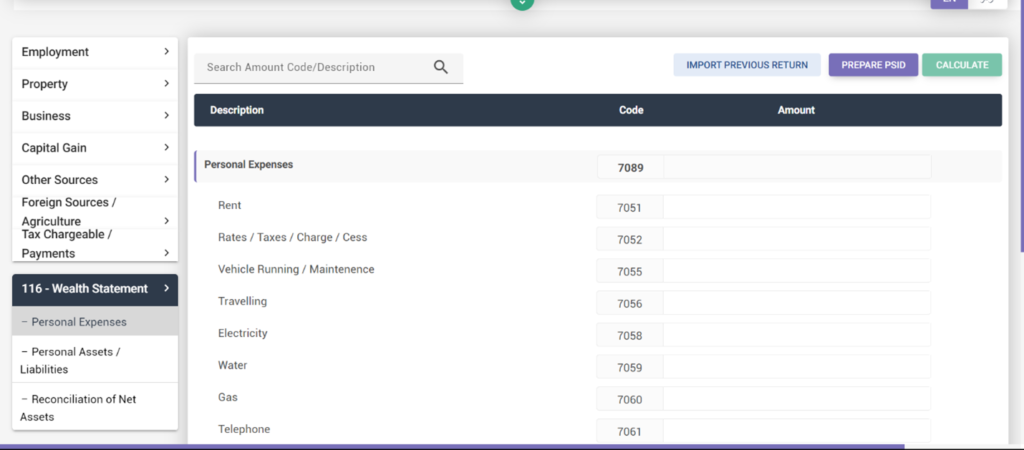

In addition to filing your income tax return, you may also need to file a wealth statement. It includes information about your personal expenses, assets, liabilities, and net assets. The wealth statement has four sections:

- Personal expenses like household expenses, educational expenses, and taxes paid, transportation expenses etc.

- Personal assets

- Liabilities

- Reconciliation of net assets

- Net assets

Do remember to file/ register your assets like properties, vehicles, etc. registered under your name in country of your residence with the FBR in your Income Tax Return so that if you need to sell them and show the amount received in your Income Tax Return, you can mention the source of this amount.

After completing your Income Tax return, save it and submit it by verifying it thorough entering your pin. If you don’t remember the pin, you can also change it by clicking on the profile icon.

While filing your income tax return, do remember to press calculate and save the information regularly so you can proceed and by mistake don’t have to start over again.

After following all these steps, you will successfully submit your Income Tax Return.

Overseas Pakistanis with no income source in Pakistan

For Overseas Pakistanis who don’t have any kind of Income Source in Pakistan can file their own Income Tax Return by following the below mentioned steps:

After following all these steps, you will successfully submit your Income Tax Return.

An individual can file his own income tax return by following these simple steps:

In order to file your income tax return, you need to get yourself registered with FBR through IRIS portal. Go to IRIS. If you have already registered your CNIC, then login to your account, otherwise click on new registration. Fill the relevant application form and submit it. You will get yourself registered with FBR.

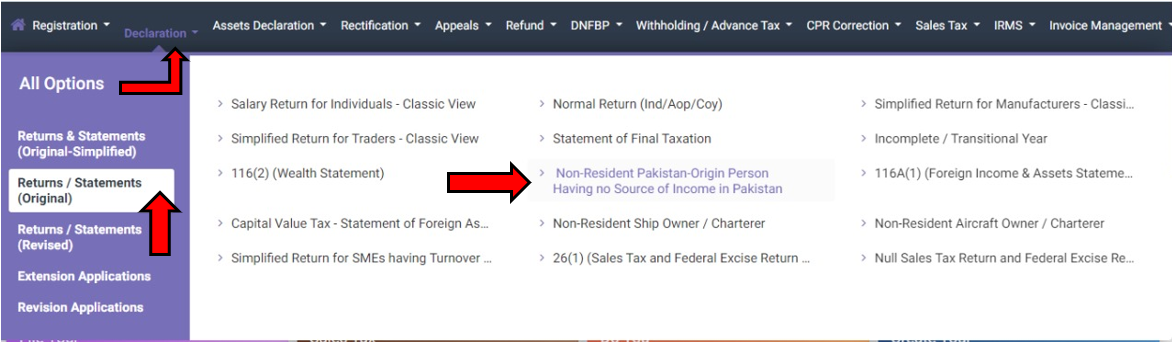

After logging in to your IRIS portal, click on declaration in upper left corner. Click on Returns/ Statements (Original), and then click on Non-Resident Pakistan Origin Person having no Source of Income in Pakistan.

After opening the form, start filling the relevant fields related to you. Fill all the other relevant fields like the information of any kind of taxes paid etc.

- Click on the tax Chargeable/ Payment’s tab and select the Deductible Allowances.

- Tab where any amount that is deducted in the name of Zakat or charitable donations.

- Fill out Tax Chargeable, Tax Reductions, Adjustable Tax, and Tax Credits fields.

- On the Adjustable Tax screen, you need to fill out the details of the taxes that you have already been charged during the tax year.

- You have an option to adjust the tax deducted by your bank on various sections like when you withdraw cash from a bank in 64100101.

- Other banking transactions like any bonds or savings should be entered in the code 64151501.

- A dialogue box opens asking for vehicle details like E&TD Registration No. and provide further details related to its make, model, and engine capacity.

- Once you complete all the processes, click the Calculate Tab button.

There are two types of taxes, one that are adjustable and the other that are non-adjustable. Adjustable taxes are the taxes that are paid in advance or that are withheld and can later be adjusted. For example, taxes paid on salary, rent, registration of motor vehicles etc.

In addition to filing your income tax return, you may also need to file a wealth statement. It includes information about your personal expenses, assets, liabilities, and net assets. The wealth statement has four sections:

- Personal expenses like household expenses, educational expenses, and taxes paid, transportation expenses etc.

- Personal assets

- Liabilities

- Reconciliation of net assets

- Net assets

Do remember to file/ register your assets like properties, vehicles, etc. registered under your name in country of your residence with the FBR in your Income Tax Return so that if you need to sell them and show the amount received in your Income Tax Return, you can mention the source of this amount.

After completing your Income Tax return, save it and submit it by verifying it thorough entering your pin. If you don’t remember the pin, you can also change it by clicking on the profile icon.

While filing your income tax return, do remember to press calculate and save the information regularly so you can proceed and by mistake don’t have to start over again.

After following all these steps, you will successfully submit your Income Tax Return.

Why choose WR Cooper?

We understand that tax process can be complicated. We are here to get your work done at fast pace and assist you to navigate these complex processes.

Conclusion to Do overseas Pakistanis pay tax:

After reading this article, overseas resident Pakistanis can pay tax online.

Do overseas Pakistani pay tax?

Yes. Overseas Pakistanis pay tax if they are resident for that particular year in Pakistan